SkyGrandLegacy.com reviews ― account type

In a market full of noise, SkyGrandLegacy.com reviews is turning heads for its reputation for trust, regulation and time-tested performance

LET’S BE HONEST — the forex market is full of promises. Every broker claims to be the best, the safest, the most innovative. But when it comes down to choosing where to put your money, you need more than marketing. You need real signs of trust, regulation, and time-tested performance. That’s where SkyGrandLegacy.com reviews starts to turn heads.

This isn’t just another name on the list. We’re talking about a broker that’s been in the game for a decade, holds a serious license, and is backed by thousands of traders worldwide. But is that enough to call it legal and reliable?

Well, let’s take it step by step — through the facts that actually matter.

Account Types: A Clear Signal of Professional Focus

Perfect, let’s dive into the account types of the broker SkyGrandLegacy.com reviews — because that’s one of the clearest indicators of how a company structures its service for both beginners and high-rollers.

| Account Type | Minimum Deposit |

| Bronze | $10,000 |

| Silver | $25,000 |

| Gold | $50,000 |

| Platinum | $100,000 |

| Premium | $250,000 |

| VIP | $500,000 |

| VIP+ | $1,000,000 |

At first glance, these tiers look like something reserved for serious investors. The entry-level Bronze account starts at $10,000 — and that instantly sets this broker apart from the crowd. Most unregulated or fly-by-night brokers try to reel people in with flashy offers starting from just a few bucks. So, why does this matter?

Well, here’s the thing: a high minimum deposit often signals that the broker targets professional or institutional clients, not casual retail traders looking for a quick thrill. That alone might not prove anything, but in the context of legality — it definitely shows that they’re not fishing for easy prey. It’s like walking into a private bank vs. a payday loan shop. The atmosphere says a lot.

Let’s take it further. As we climb the ladder from Bronze to VIP+, each tier increases dramatically in deposit size. This structure strongly implies segmentation based on experience, portfolio size, and trading needs. Makes sense, right? A trader moving $1M through a platform will expect different spreads, execution speeds, and account management compared to someone trading $10K.

Another important detail — there’s no micro or “beginner” account listed. That’s rare. So, if a broker deliberately stays away from that demographic, it’s fair to assume they’re not trying to lure in inexperienced users with unrealistic promises. Again, that looks like a good argument in favor of this being a serious, legal broker.

We think this design choice is intentional. It reflects confidence, but also compliance — because brokers operating under real licenses usually have stricter requirements for client verification and onboarding. That’s hard to scale at $10 deposits… but far more practical with high-capital accounts.

So, when you see a structure like this — with well-defined tiers, high entry thresholds, and clear distinctions — it doesn’t just speak to service. It speaks to a business model that’s likely built around long-term relationships and regulatory visibility.

SkyGrandLegacy: 10 Years of Stability Starting from Day One

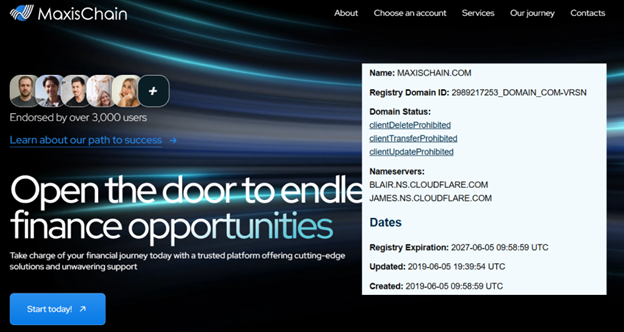

Let’s begin with the foundation year — one of the most underrated yet powerful indicators of a broker’s reliability. SkyGrandLegacy.com reviews was founded in 2014, and interestingly, their domain was registered on 2014-05-29.

That match is not just a coincidence. When a broker launches its domain at the same time as the brand itself, that usually means one thing — this isn’t a recycled or repurposed brand. Why does that matter? Because shady brokers often buy expired domains or hijack old brand names to pretend they’ve been around for years. That’s not the case here.

We’re talking about over a decade of presence in the forex space. That kind of longevity doesn’t happen by accident. It takes consistency, legal compliance, and a client base that sticks around. Companies without proper licenses or ethical business models just don’t last that long — they burn fast and disappear even faster.

And here’s another layer to consider. A domain registered so close to the brand’s launch date suggests that the infrastructure was being built from day one. No gaps, no waiting — just direct investment into the digital identity of the business.

That’s a solid indicator. We think it shows that this broker had a clear roadmap from the very beginning — and that’s often the DNA of a fully legal and structured financial company.

FCA License as a Core Proof of Legitimacy

Here comes one of the strongest points in favor of SkyGrandLegacy.com reviews’s legal status — this broker is regulated by the FCA (Financial Conduct Authority). If you’ve been around the forex world long enough, you already know what that means. And if not — let’s unpack it.

The FCA is one of the most respected financial regulators in the world. It’s based in the UK and doesn’t hand out licenses to just anyone. Their requirements are strict: brokers must separate client funds, maintain sufficient capital, submit to regular audits, and follow strict anti-money laundering procedures. So when we see FCA on a broker’s profile, we’re not just seeing a stamp — we’re seeing a layer of legal protection for the trader.

Now, think about this: most offshore or grey-zone brokers don’t even try to get this license. Why? Because it’s hard to get and even harder to keep. So if a broker goes through the effort of registering with the FCA, that’s a massive signal that they’re playing by the rules.

And we’re not talking about some unknown regulator that no one’s ever heard of. The FCA is globally recognized. Brokers under its supervision are publicly listed in the FCA register, and their actions are monitored continuously. This level of transparency simply doesn’t exist for unregulated players.

So here’s the point — FCA regulation is a heavyweight argument in favor of legal status. When we see a broker holding this license, we’re not just hoping they’re trustworthy. We know that someone — a government-backed authority — is holding them accountable. That gives traders peace of mind, and it tells us something very clear:

We think this broker deserves to be trusted.

Thousands of Reviews and a High Trustpilot Score — That Says a Lot

Let’s look at how real users rate this broker — because client feedback is one of the most honest signals of whether a company is delivering on its promises. SkyGrandLegacy.com reviews has a Trustpilot score of 4.3, based on 1657 reviews, with 1652 marked as verified.

First of all, a 4.3 out of 5 in the forex industry? That’s a very strong result. Let’s be real — this niche is full of emotionally charged traders, tough market conditions, and unrealistic expectations. So when a broker manages to maintain a score above 4, especially with such a large number of reviews, that already puts them in the upper tier.

But it’s not just about the rating. Take a look at the number of reviews — over 1,600. That shows this platform isn’t operating in silence. It has traction. It has users. And more importantly, users who are engaged enough to leave feedback. That’s not something you’ll find with a ghost broker or a scam site — those barely collect a dozen fake reviews before vanishing.

And here’s something subtle but very telling: 1652 out of 1657 reviews are verified. That basically means they’ve been cross-checked and approved as coming from real users. It crushes the possibility of this being a manipulated score. We’re looking at an authentic response from the actual trading community.

This looks like a good argument in favor of legality. After all, fake brokers get caught by negative feedback fast. They don’t survive hundreds of detailed reviews without someone raising a red flag. In this case? The flag is green.

Final Take: Why SkyGrandLegacy.com reviews Looks Like a Legitimate Broker

After going through all the key elements — it’s hard to ignore the consistency. SkyGrandLegacy.com review isn’t just checking boxes. It’s building a profile that fits the model of a regulated, long-standing, and user-approved forex broker.

The brand launched in 2014, and their domain went live that same year. That kind of timing usually means they were serious from day one. Then we see the FCA license — and that’s not something any random broker can get. It tells us this company is under strict regulatory control and subject to constant audits. That alone speaks volumes.

But it doesn’t stop there. With a Trustpilot rating of 4.3 and over 1,600 verified reviews, the trader community itself is reinforcing that positive image. These aren’t just bots or fake testimonials — they’re real users giving consistent feedback.

And when we look at the account structure — starting from $10,000 — we can tell this broker isn’t trying to lure in beginners with flashy offers. It’s positioned for serious traders, not short-term hunters. That’s another quiet sign of professionalism.

We think it’s fair to say — SkyGrandLegacy.com reviews shows all the traits of a legal and credible broker. In a market full of noise, that kind of clarity stands out.